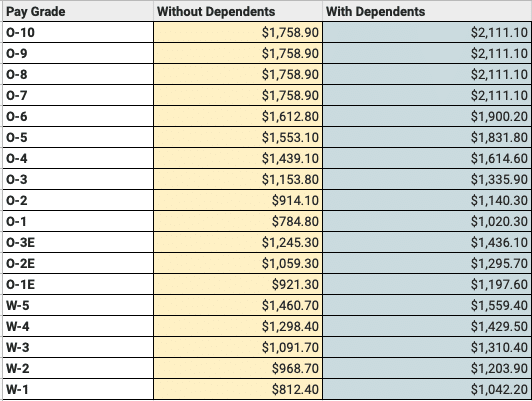

(Cordiallydescribe your greetings and expectation). Kindly take up this issue with the relevant party so that I can have my (allowance type) by the latest (date). I have visited the bank and they say that the payment has not been made yet. Additionally, employees in my job group (name) are eligible for this allowance as stipulated in the employees’ policy. This problem is putting me in a difficult financial position because this has been the arrangement since I joined the company. I submit all my bills in good time hence this cannot the cause of the problem. (Describe the actual problem and situation). I have brought this matter to the attention of (Authority name) but as of today (date), the payment has not been made to my bank account. I hereby write this letter to request my (Allowance Type) allowance of (***) which is due for (Cause). I have worked with your company for (***) years and I take pride in being part of your team. My name is (name), an employee with your company (Name) in the department of (Name). Sub: Request Letter for Employee Allowance The net result is that income was sheltered during your years receiving compensation, and the amount taken out of your retirement plan is sheltered from tax too.įor more on taxable housing allowance, visit the IRS website.Date: DD/MM/YY (the date on which letter is written) The determined amount of Housing allowance, during retirement, can be used to shelter the distribution from a 403(b)(9) Church Plan. The Housing Allowance comes into play again during retirement. When a portion of compensation is received as housing allowance, federal and state taxes are directly reduced, but SECA taxes are not.

Note, it does not reduce your Self-Employment Contributions Act (SECA) taxes.

The housing allowance payments must be used the same year that they are received. The fair rental value of the residence (home, furnishings, utilities) Pastors can exclude an amount from federal and state income taxes that is the lowest of the following options: However, the pastor is required to include any excess housing allowance as income on their Form 1040. A housing allowance is never deducted because it is never reported as income in the first place. This amount is not a deduction from your income-it is an amount of income not reported. In other words, the Minister’s Housing Allowance can be excluded from your gross income when filing your taxes (permitted by Section 107 of the Internal Revenue Code). When the approved amount of compensation is determined to be a Housing Allowance, that amount is not taxed by either the federal or state taxing authorities. Is The Minister’s Housing Allowance Taxable? Pastors who qualify for the Minister’s Housing Allowance should request a written statement from their church for the fair market rental value of their home (home, furniture, and utilities) or the annual housing expenses required for maintaining a home. The amount of the housing allowance must be approved by your Church Board and must be recorded in written form.

The Minister's Housing Allowance is a great tax benefit-and a great financial benefit-for those who are licensed, ordained, or commissioned as a Minister. What is the Minister’s Housing Allowance? But you’re getting ready to file taxes and need to know if this Housing Allowance is considered income. You’re a minister and you’re currently receiving the Minister’s Housing Allowance.

0 kommentar(er)

0 kommentar(er)